Most everyone remembers the “Miracle on Ice.” The United States men’s hockey team defeated the Soviet Union 4-3 at the 1980 Winter Olympics in Lake Placid, N.Y. At the time, and now, some four decades later, it is considered to be one of the greatest upsets in modern sports history.

But, what many people might not remember, is that the two countries did not meet in the final. After beating the Soviet Union, the United States still had to go out and win their last game — against Finland — to take home the gold medal; a game the U.S. won 4-2.

Remembering those games can remind you of the current situation in the credit and collection industry. The release of a proposed debt collection rule from the Consumer Financial Protection Bureau can make companies in the industry feel like they have beaten a mighty adversary. But there is still work to be done.

Collection agencies may want to run out and start sending emails and text messages and using the new limited content messages, but they should avoid doing so just because the proposed rule has been released, said a panel of executives who spoke recently on a webinar sponsored by InterProse about how to adapt operations following the proposed rule’s release. Check out a recording of that webinar by clicking here:

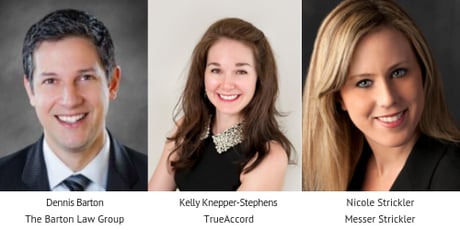

The panelists — pictured at right — preached patience when it comes to making changes based on what the proposed rule proposes. The law has not yet changed, and will not change, until the CFPB issues a final rule and that final rule goes into effect. That is still a ways off in the future. For now, the industry can look at the proposed rules and what is likely to be included in the final ruling, and hope that it looks much as it does today considering most of the proposed changes are acceptable and bring additional clarity to regulations. However, until it is final, agencies should not treat the proposed rule as anything other than some insight into what the CFPB is thinking.

That said, much like the U.S. win over the Soviets, there is much to be excited about. What the CFPB has proposed is to modernize a 42-year-old law and make it easier for companies in the credit and collection industry to communicate with individuals who have unpaid debts. That is definitely a gold medal worth waiting for.