Make that Data Work for You

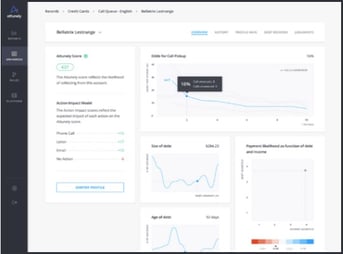

Attunely is a Seattle, WA based technology company taking the ARM industry by storm. Having launched in February 2019, Attunely is quickly creating a buzz in the debt recovery market with their advanced machine learning platform and blended team of machine learning, technology, and collections veterans. To date, their platform has delivered an average 15% increase in top line collections.

With a native integration to ACE, and access to data points unique to the web-based ACE platform, Attunely is now equipped to deliver immediate incremental recoveries to all InterProse customers.

Attunely’s integration with ACE is currently their deepest, and all the hard integration work is done. All you have to do is sign up to enjoy the most powerful optimization capabilities available to the debt collection market.

Attunely makes this easy. You have valuable data housed deep within your InterProse system that Attunely can now leverage to boost immediate incremental recoveries.

Attunely makes this easy. You have valuable data housed deep within your InterProse system that Attunely can now leverage to boost immediate incremental recoveries.

THREE

THREE  TWO

TWO  FOUR

FOUR